Your TV or clubs are in the trunk as well as after that it just figures? someone rear-ends your automobile. Relax guaranteed. ERIE will give you as much as $350 toward your personal belongings not covered by various other insurance coverage. You acquired a brand-new vehicle as well as appreciate it a lot that you forgot to let your representative recognize about it.

Just let us understand within 7 days of the acquisition so that you have the appropriate insurance coverage. If you have inquiries about car insurance policy discounts or ERIE "Xtra Protection Features," talk to your Agent.

3Applies just to policies in the Erie Insurance Policy Exchange; in OH as well as WV readily available just for Preferred plans; in NY only available in the Erie Insurance Coverage Business; Discount not readily available in NC4 Not available in KY as well as NC (cheaper car). Can not be made use of combined with the Minimized Use Discount.

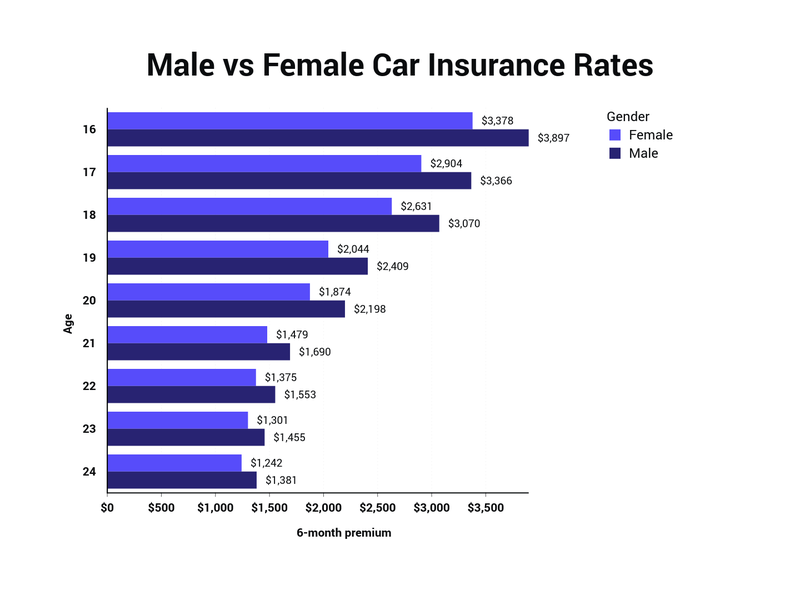

Since brand-new vehicle drivers are just obtaining their motorist's license, they typically don't have an official driving document or background. New chauffeurs may fall under the complying with groups:Teens getting a driver's permit after getting to legal driving age Adults who find out or start driving later in life, such as citizens from areas like NYC or New Jersey transferring to the suburbs Grownups that may have a gap in their driving record because they canceled their insurance when they sold their auto in the past, Immigrants or others who are brand-new to the U.S.Being a new motorist in the U.S.

Not having years of driving experience can trek up car insurance coverage premiums as insurance providers might regard Visit this site you a danger since there are no previous years to describe (cheapest car insurance). Similar to the means not having a credit scores account can cause greater rate of interest on points like car loans or a bank card, automobile insurance premiums may be greater when there is no verifiable history.

Some individuals assume that your auto insurance coverage rate will decrease immediately as soon as you reach a specific age, however it's not real; that's simply a myth. One more factor car insurance coverage might likewise be much more pricey is if you can not show a track record of risk-free driving or continuous insurance policy protection with time.

4 Simple Techniques For Tips On Lowering Premiums - Missouri Department Of Insurance

New drivers come from all profession, and also numerous aspects add to the price you obtain (new motorist or not). Being a new chauffeur is just one part of the threat evaluation. cars. But auto insurers may check out your postal code, credit report, marital standing, sort of cars and truck, as well as even more to establish the degree of threat.

We likewise discovered that individuals who don't have established credit score histories (like immigrants) can pay about the very same costs as somebody with a DRUNK DRIVING.

If that's the instance, pay-per-mile insurance coverage is excellent car insurance policy for new drivers because you pay based upon just how much you drive. Why pay even more when you may be able to pay also less based upon the miles you drive? Let's have a look at seven reasons pay-per-mile protection is good car insurance for new drivers.

So with pay-per-mile insurance, you can conserve cash by paying for the miles you drive. 2. You got your license and also began driving later in life If you expanded up in a significant city that relies upon public transport, you might have never needed to discover how to drive or had a possibility to learn.

Possibly you always allow your partner drive, and now you desire some freedom to do points on your timeline. Although in these cases you're older and also smarter, you're still considered a new driver as you're obtaining your permit for the very first time and have an absence of driving history (insurance).

cheap insurance credit cheaper cars cheap car

cheap insurance credit cheaper cars cheap car

You took a break from driving and had a gap in coverage If there are spaces in driving experience and insurance policy coverage, you may be thought about a brand-new driver. In that case, you might have greater prices, however you can save with pay-per-mile insurance policy if you're relieving into driving as well as don't rack up that lots of miles.

Fascination About Why Does My Car Insurance Go Up As My Car Gets Older?

You simply relocated to the U.S.You may be a knowledgeable driver somewhere else but if you just relocated to the U.S., you might be thought about a new motorist. As an immigrant, you may not have a driving or insurance policy document in the U.S., which is made to assist you replace or pay for repairs to your car.

If there are several people on the plan, it is necessary to comprehend how the insurer designates vehicle drivers to cars as it can impact the overall cost. auto. For instance, if a policyholder has a brand-new cars and truck, however you get on the policy with an older vehicle, you might or may not see additional cost savings.

Metromile's pay-per-mile auto insurance policy uses 4 different levels of obligation protection as well as selections for your extensive as well as crash deductibles so that you have better control over just how much you wish to pay. If you're trying to find vehicle insurance coverage for brand-new vehicle drivers, this could be a good alternative that is personalized for your demands - cheap insurance.

You took a defensive driving course and might rack up a brand-new vehicle driver price cut If you're in search of car insurance coverage for brand-new motorists, you intend to locate cost effective coverage. If you take a protective driving course, you may be able to rack up a lower price. In some states, Metromile provides discount rates to brand-new vehicle drivers who take a defensive driving course.

It additionally reveals an insurance coverage business you're taking actions to end up being a safer chauffeur. Your vehicle has safety features, If your automobile has security functions such as automatic seat belts, airbags, tracking tools, and so on, you might obtain a lower price with pay-per-mile insurance coverage.

Some Ideas on When Do Car Insurance Rates Go Down? - Allstate You Should Know

Just how much could Metromile save me on cars and truck insurance coverage? There's no doubt that cars and truck insurance for novice drivers may be extra expensive because of higher levels of threat and no record to describe. Pay-per-mile car insurance coverage with Metromile can be great auto insurance policy for brand-new motorists as well as keep expenses much more cost effective if you're not driving that much.

The bottom line It can seem like a huge action to get your certificate and also be free to drive however you may be prevented by the high cost of car insurance coverage for brand-new motorists - low-cost auto insurance. New motorists can take into consideration pay-per-mile coverage as a method to reduce expenses if driving much less while obtaining even more experience when driving.

To discover the very best vehicle insurance coverage for new vehicle drivers, obtain a cost-free quote with Metromile.

When you got your driver's permit, you could've been stunned by just how much you had to pay your insurance coverage companyand you didn't also have an accident. You could not wait to turn 25 and also have those high auto insurance policy rates lastly come down. Besides, it's typically believed that cars and truck insurance coverage premiums instantly drop for vehicle drivers at age 25.

It's more of a gradual decline when it comes to the correlation between cars and truck insurance coverage rates as well as age. One point that does effect insurance coverage policy rates for all insureds, yet particularly at more youthful ages, is whether an insurance policy score is factored into the expense.

Naturally, there are likewise things that will raise prices. If your driving history has website traffic offenses or crashes, if you're living in a more booming area, you had your credit report score decrease, or you included chauffeurs, you might see higher costs that have you paying more for crash insurance coverage (auto insurance).

A Biased View of Tips On Lowering Premiums - Missouri Department Of Insurance

This myth is exposed. Examine out what you could be able to save today.

Threat assessors have determined that those 25 or older are much more likely to be a lot more liable which their risk of at-fault mishaps has actually reduced. The base rate for your car insurance policy modifications at this age due to the fact that you've matured into a better chauffeur class; it's not a vehicle insurance coverage discount for transforming 25 as some think.

Insurance business rating systems and also factors can vary, along with the state regulations governing them, so just how much your vehicle insurance prices will change will differ. We have seen rates decreased as high as 20 percent once a vehicle driver gets to the age of 25, if that individual has maintained a clean driving document and had no crashes - dui.

Of course, we all wish the costs has gone down. Great news though: In some cases you can get an insurance policy decrease without having to in fact do anything to obtain much better prices. Allow's explore some means that might save you some cash.

You can check your Car Document (MVR) by mosting likely to the MTO face to face or online below. When we say tickets, we mean convictions such as speeding tickets, seatbelt, stop indication, DUI, and so on. If you fight the ticket in court and also are successful, then those do not trust your driving record.

low-cost auto insurance credit score vans car insurance

low-cost auto insurance credit score vans car insurance

car insured auto insurance prices low cost auto

car insured auto insurance prices low cost auto

Whew. Another thing that does not matter is demerit factors. Demerit factors have zero influence on your insurance coverage rates. It is a commonly held misconception! Bad mark points are just utilized to suspend or retract chauffeur's licenses. Numerous minor tickets don't included any type of bad mark points, yet the tickets will still affect your insurance policy rates. affordable auto insurance.

Rumored Buzz on Auto Insurance Rates Might Be Going Up In 2022 - Fortune

: 6 years The length of time Do Non-Payment Cancellations Effect Fees? Terminations for non-payment remain on your document for 3 years total. Make certain you don't obtain terminated by the insurance coverage firm because you can't pay. This has influence on your prices should you intend to get insurance policy again.: 3 years At What Age Will My Insurance Policy Rates Decrease? This inquiry gets asked a whole lot by more youthful chauffeurs.

For boys, your rates likewise decrease at 19, 21, and also 23 years old - low cost. Once you strike retirement age, you can get approved for an additional discount rate. If you are over 65 OR are receiving income under the Canada Pension, you can receive a price cut of around 3%. It's very little of a saving, yet you may also make use of anything you can get.

affordable auto insurance auto cheapest car insurance laws

affordable auto insurance auto cheapest car insurance laws

As your auto ages, the value typically depreciates. The less the automobile deserves, the less it sets you back to fix or change. Your automobile insurance prices should go down as your cars and truck obtains older, all points being equivalent? Not all factors are equivalent when establishing cars and truck insurance prices.

Of program, we all wish the premium has actually gone down. Excellent information though: Sometimes you can obtain an insurance policy decline without having to in fact do anything to obtain better prices. Let's explore some means that could save you some cash.

You can examine your Automobile Record (MVR) by going to the MTO personally or online below. When we claim tickets, we imply convictions such as speeding tickets, seatbelt, stop indicator, DRUNK DRIVING, etc. If you battle the ticket in court and also are successful, after that those do not rely on your driving document. dui.

Bad mark factors have zero impact on your insurance coverage rates. Demerit factors are only made use of to put on hold or retract chauffeur's licenses. Numerous minor tickets do not come with any bad mark factors, yet the tickets will certainly still affect your insurance policy rates.

Not known Details About 5 Ways To Keep Your Car Insurance Costs Down - Consumer ...

Make certain you do not get cancelled by the insurance policy business due to the fact that you can't pay. This has influence on your prices should you desire to obtain insurance again.: 3 years At What Age Will My Insurance Policy Fees Decline?

For young guys, your rates likewise go down at 19, 21, and 23 years of age. credit score. It's not much of a conserving, however you might as well take benefit of anything you can obtain.

As your car ages, the worth typically decreases. The less the vehicle is worth, the less it sets you back to fix or change. Your automobile insurance policy prices should go down as your auto obtains older, all things being equivalent? Nevertheless, not all factors are equivalent when determining auto insurance coverage prices.